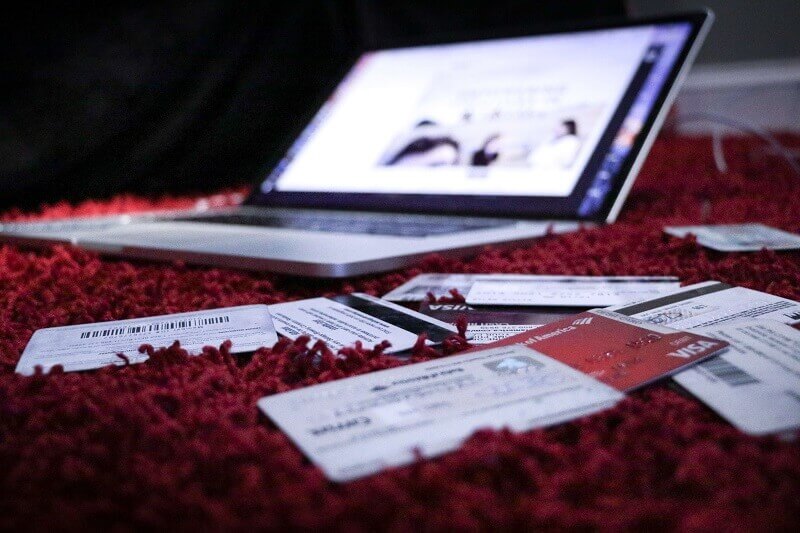

Mastering the Basics of Good Credit Management

Good credit management is a fundamental aspect of financial well-being, yet many people struggle to understand the basics of maintaining a healthy credit profile. From paying bills on time to monitoring your credit report, mastering the fundamentals of credit management can have a significant impact on your financial future. In this article, we’ll explore five essential strategies for mastering the basics of good credit management and building a solid foundation for long-term financial success.

Understand Your Credit Score

Your credit score is a numerical representation of your creditworthiness and plays a crucial role in determining your ability to borrow money and access financial products. Understanding how your credit score is calculated and what factors influence it is essential for effective credit management. Factors such as payment history, credit utilization, length of credit history, types of credit accounts, and new credit inquiries all contribute to your credit score. By regularly monitoring your credit score and understanding the factors that impact it, you can take proactive steps to improve and maintain a healthy credit profile.

Pay Bills on Time

One of the most critical aspects of good credit management is paying bills on time. Late payments can have a significant negative impact on your credit score and may result in late fees, increased interest rates, and even collection actions. Make it a priority to pay all of your bills, including credit card bills, loans, and utilities, by their due dates each month. Consider setting up automatic payments or reminders to ensure that you never miss a payment. By consistently paying bills on time, you can demonstrate reliability and responsibility to lenders and improve your creditworthiness over time.

Manage Your Credit Utilization

Credit utilization refers to the percentage of your available credit that you are currently using and is another crucial factor in determining your credit score. Ideally, you should aim to keep your credit utilization ratio below 30% to maintain a healthy credit profile. Avoid maxing out your credit cards or carrying high balances from month to month, as this can signal financial instability to lenders and negatively impact your credit score. Instead, strive to keep your balances low and pay off your credit card balances in full each month whenever possible. By managing your credit utilization effectively, you can improve your credit score and demonstrate responsible credit management to lenders.

Regularly Monitor Your Credit Report

Regularly monitoring your credit report is essential for identifying errors, inaccuracies, or fraudulent activity that could negatively impact your credit score. Federal law entitles you to one free credit report from each of the three major credit bureaus—Equifax, Experian, and TransUnion—every 12 months. Take advantage of this opportunity to review your credit report for any discrepancies and dispute any inaccuracies promptly. Additionally, consider enrolling in a credit monitoring service that provides ongoing monitoring of your credit report and alerts you to any suspicious activity. By staying vigilant and monitoring your credit report regularly, you can detect and address potential issues before they escalate and protect your creditworthiness.

Avoid Opening Too Many New Accounts

While having a mix of credit accounts can positively impact your credit score, opening too many new accounts within a short period can have the opposite effect. Each time you apply for new credit, a hard inquiry is placed on your credit report, which can temporarily lower your credit score. Additionally, having too many new accounts can signal to lenders that you are overextending yourself financially and may be a higher credit risk. Instead, focus on maintaining a healthy mix of credit accounts, including credit cards, loans, and mortgages, and only apply for new credit when necessary. By being strategic about opening new accounts and avoiding unnecessary inquiries, you can protect your credit score and maintain a solid credit profile.

In conclusion, mastering the basics of good credit management is essential for achieving financial stability and success. By understanding your credit score, paying bills on time, managing your credit utilization, regularly monitoring your credit report, and avoiding opening too many new accounts, you can build a solid foundation for long-term financial health. By implementing these strategies and making credit management a priority, you can improve your creditworthiness, access better financial opportunities, and achieve your long-term financial goals.